In today’s write-up, we’ll be diving deep into Kujira, the cosmos L1 that quickly rose from the ashes of Terra’s catastrophic collapse. Here’s the breakdown of what’s to come:

What is Kujira?

BLUE (central application)

FIN (CLOB DEX)

USK (CDP stablecoin)

ORCA (liquidation queue)

KUJI (governance and fee token)

More to be excited for

Synergistic Value

Statistics & growth

What is Kujira?

Kujira’s story starts back in October of last year with the launch of ORCA, their innovative and successful liquidation mechanism in collaboration with Anchor Protocol. At their peak, just before the Terra collapse, ORCA managed to achieve a TVL of just over $150m.

Since then, they’ve done more than one could imagine. They’ve launched their very own Cosmos L1 within 3 months of the Terra collapse; launched FIN on the main-net with steadily growing volumes; ready to re-launch ORCA; and announced plans for their CDP stablecoin, USK.

The centre of Kujira’s vision is what they call “Grown-up DeFi”, where protocols are revenue generating, yield is sustainable, and finance is fair.

BLUE (central application):

BLUE is the central application of the Kujira ecosystem. It hosts all of the essential features such as basic swaps (through FIN but without the complexities), aggregated bridging (Axelar & Cosmos IBC), staking, governance, and a dashboard giving you the basic network statistics.

FIN (CLOB DEX):

Let me guess, you read “CLOB DEX” and now you’re wondering what the hell it means? Let’s take a look.

The majority of decentralised exchanges (DEXes) we see and use today are using an automated market maker (AMM) infrastructure, this is where there are liquidity providers (LPs), and traders. This architecture comes with multiple issues.

The first issue is on the protocol side and it’s to do with token emissions, you see, LPs need to be incentivised to take on the risks associated with LPing. The only way to incentivise it? token emissions. These token emissions can come from the DEX, or the project. If incentivised by the DEX, the DEX is running at losses for years on end. If incentivised by the project, the project’s token faces constant sell pressure. Both cases are inadequate for long-term sustainability.

The second issue is on the LPs side — Impermanent Loss (IL), yeah, the thing we all hate. I remember when I went into my first LP thinking I was going to earn a 700% APR, but then I was down 50% in a week. Not my favourite experience.

FIN leaves both of these issues in the past by utilising Central Limit Order Books (CLOB), an architecture already used in stock exchanges and centralised crypto exchanges like Binance. The only difference is the fact that Kujira’s is 100% on-chain.

When it comes to order matching, FIN uses a non-FIFO (first-in-first-out) method, meaning orders at each price are aggregated and executed pro-rata rather than the usual FIFO method, where orders are executed based on the time of order, which in most cases results in an unfair market.

FIN also guarantees 0% slippage when using limit orders, while AMM DEXes which have just added an orderbook on-top of an LP cannot.

No emissions, no incentives, and no impermanent loss. Just buyers against sellers, removing the market inefficiencies we all hate.

Using this model, there are now two participants, makers, and takers.

Makers refer to the users who set limit buy or sell orders that are to be exercised at a later time (whenever someone else makes an opposing trade at that limit price). These users are effectively adding liquidity to the market.

Takers are the users who place market or limit orders that are filled immediately, essentially taking liquidity off of the market.

Fees for makers and takers are 0.075% and 0.15%, respectively.

USK (CDP stablecoin):

The most recent addition to Kujira’s suite of products is its Collateralised Debt Position (CDP) stablecoin, USK. Collateralised Debt Position stablecoins are already widely used in DeFi (DAI). To mint 1 USK, you must provide collateral at a Loan-to-Value (LTV) ratio of at least 60%. This means that by posting $1 of collateral, say ATOM, you will be able to mint a maximum of $0.60 worth of USK. If the LTV rises past this point, liquidation occurs through ORCA (we go through a liquidation event down under ORCA).

I know what you’re thinking, “A project from Terra, making another stablecoin…?!”. Yes, yes, but there’s no need for concern. Due to the collateralised nature of USK, the risk of a death spiral is non-existent, and on top of that, it removes the ecosystem’s reliance on centralised stablecoins like USDC, which have been bridged from Ethereum. As we all know, bridging comes with many risks (billions stolen from bridges to date).

Initially, ATOM will be the sole form of collateral, but this will later be expanded to include KUJI, and other NON-bridged assets.

ORCA (liquidation queue):

Currently, If you go to any lending market or leverage trading platform, you’ll likely find that liquidations are almost entirely done by users equipped with significant capital, and the technical know-how to build bots. These users make excessive returns while taking on little risk.

ORCA changes this.

Rather than having liquidation markets that are first come, first served (FCFS) in which bots dominate, the market is based on a liquidation queue. Whenever a liquidation occurs, the bids at the lowest liquidation premium are filled, this minimises the cost of liquidation for the borrower, while also allowing the market forces to choose the fair liquidation premiums.

The best way to explain this is with an example:

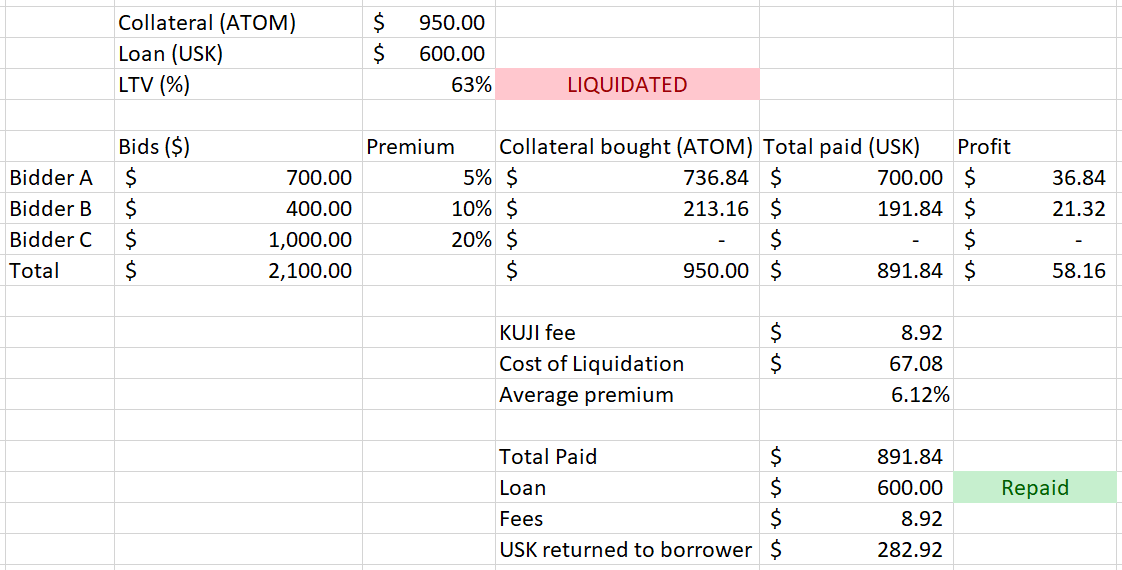

A borrower has locked $1,000 worth of ATOM as collateral to mint $600 worth of USK, the maximum amount due to the 60% LTV.

The ATOM’s value suddenly drops to $950, and they are yet to repay their loan, and hence, they are liquidated.

Due to liquidations being done through ORCA, this collateral is going up for auction at a spot price of $950 and will be sold to whoever is willing to pay the highest price (aka. the lowest premium).

Current bids for ATOM via ORCA are as follows (bids are in USK):

Bidder A: $700 at a 5% premium.

Bidder B: $400 at a 10% premium.

Bidder C: $1,000 at a 20% premium.

Bidder A’s orders are completely filled due to having the lowest premium.

Bidder B’s orders are partially filled due to having the next best premium.

Bidder C’s orders are left untouched due to having a premium too high.

So, what are the outcomes in this scenario?

Bidder A paid $700 in USK to buy $736.84 worth of ATOM (Up $36.84).

Bidder B paid $191.84 in USK to buy $213.16 worth of ATOM (the remaining collateral) and still has $208.16 worth of USK left in ORCA bids (Up $21.32).

Bidder C is left with $1,000 worth of USK in ORCA bids as the collateral has already been bought up by bidders at lower premiums (unchanged)

The $891.84 paid for the collateral is then split as follows:

$8.91 is sent to KUJI stakers as a liquidation fee (1%)

$600 is used to repay the borrower’s loan.

The remainder, $282.92, is sent back to the borrower.

The borrower is left with the loan they took out, $600 in USK, and $282.92 worth of USK from the liquidation, totalling up to $882.92 (Down $67.08).

Here’s an excel breakdown:

In the ORCA interface shown below, we see that liquidation premiums range from 0-35% (x-axis), this range changes depending on the underlying market LTV. The higher the max LTV, the lower the max premium.

The ORCA liquidation queue can also be implemented into any lending market, making its addressable market effectively all of DeFi liquidations.

KUJI (governance and fee token):

Fees. Fees. Fees.

The KUJI token captures all fees from the Kujira suite of apps, these include:

Network Fees

FIN trading fees (maker: 0.075%, taker: 0.15%)

ORCA withdrawal fees (0.5%)

USK minting fees (0.5%)

USK interest fees (5%)

USK liquidation fees (1%)

By staking KUJI on BLUE, you can earn your fair share of the aforementioned fees. The APR currently sits at 1.85% (7-day average) of pure yield generated by real app usage. No inflationary yield. It’s worth noting that at the time of writing, the only product currently live is FIN, with 7-day volumes sitting at around $4.5m.

There is huge room for growth here. As a simple comparison, Osmosis, the main DEX of the Cosmos has been doing weekly volumes of ~$90m during the bear market, and at its peak did a weekly volume of ~$1.38b. If FIN were to capture the equivalent volumes, we could see an APR of 37% (bear), or 566% (bull), that is of course presuming the % of KUJI staked, and the KUJI price stays at current levels (very unlikely). This is from FIN alone, ignoring ORCA, USK, and future products.

The reason those numbers are so high? because the fees don’t need to go to LPs, instead 100% of fees go directly to KUJI stakers, as simple as that.

These figures are pure speculation, but they are definitely possible.

On top of this, a growing theme among protocols launching on Kujira is revenue sharing.

Local, a project offering decentralised on-off ramps has mentioned that 10% of their revenues will go to KUJI stakers.

BlackWhale, a project that aims to decentralise market making, has also mentioned that 50% of their fee revenue will go to KUJI stakers. However, the 50% will be split (proportions of the split are yet to be mentioned) between stakers to their validator, and all KUJI stakers.

Another important factor to note is KUJI’s low inflation, and I mean LOW. There are no emissions promoting usage. No emissions incentivising liquidity.

On top of yield from fees, the KUJI token:

Secures the Kujira network

Has voting power in governance decisions such as:

What protocols can launch on Kujira

Protocol upgrades

Protocol parameter changes

and more.

More to be excited for:

If the things I’ve spoken about thus far haven’t already excited you enough, there is more.

Margin trading on FIN (up to 10x). Leveraged longs are coming first and will utilise USK to lever up. Leveraged shorts will require a lending market, so will be postponed to a later date (did someone say lending market? 👀). Liquidations are of course powered by ORCA, so, as you can imagine, if traders are out there getting liquidated due to over-leveraged longs/shorts, YOU benefit.

FIN referrals.

CALC Finance — Dollar-cost-average (DCA) bots.

ORCA expansion into new lending platforms (Acala coming soon).

Kujira Wallet.

Synergistic Value:

One of the things that stands out significantly for Kujira is its synergistic value. It’s everywhere, and it’s impressive. How the different apps intertwine is unrivalled when compared to everything else I’ve seen in DeFi.

— ORCA liquidates USK CDPs when above the max LTV

— ORCA liquidates margin traders on FIN

— USK will be used as the quote stablecoin on FIN

— USK will be the major bidding asset on ORCA

Each app promotes the usage and success of other Kujira applications.

Stats:

7-day Volumes on FIN:

I think we can all agree that there is a nice up-trend here. Majority of trading volume is from the KUJI-axlUSDC pair, but other pairs are also growing in volumes.

Thank you all for reading, and I hope it provided you with some useful insights!

DISCLAIMERS:

I do own KUJI, but I am neither affiliated nor paid by the Kujira team.

I am NOT a financial advisor. This newsletter is strictly educational and is not investment advice nor a buy or sell recommendation on any financial assets. Be careful and always do your own research before investing in speculative assets.